Buy Property in Spain

Want to buy property in Spain? People from all over the world have done it, and you can too! But first, inform yourself about the costs, processes and potential pitfalls associated with buying property in Spain. All of this is covered here.

On this Page

Buy property in Spain: how to find your dream property

Buy property in Spain: important terminology

Make sure you understand all the terms below before buying property in Spain, and see which ones apply to the area of Spain you are interested in.

Buy property in Spain: things to remember

What you will need:

To buy property in Spain you will need a NIE number. See our page here for how to get this. It will also be much easier if you open a bank account in Spain.

Be wise when dealing with estate agents/realtors

The majority of agents in Spain are legitimate. However, there are still quite a few that appear from time to time who are either pure scammers, or they have set themselves up as an agent but don’t know much about laws and processes. It is best to do a little due diligence on your estate agent. For example:

They may have an API number, which shows they are a registered member of the industry’s professional association. Unfortunately, only Catalonia requires this number by law, but agents in other parts of Spain do frequently have it, and all the good ones will. If they don’t, then at least check that they have a NIF/CIF number, which shows they are a registered company, and look at other evidence, such as a registered address or Google reviews.

As a rule of thumb, do not transfer any money to an estate agent unless you have signed documents from them which justifies this, and your lawyer has approved it. Plus, read our section on the buying process, below, before parting with any cash!

Use a reputable lawyer

Ask around on Facebook groups in the area you are targetting and see who most people are recommending. Your lawyer should ensure you do not hand over any cash without first being in possession of the correct documents that certify what you are handing over and why. They should also check all the facts associated with the property. We’ll take you through all of this on this page, but here are just a few examples to help you see why it’s a good idea to use a competent lawyer:

- If it is an apartment or is a house located in a complex, it is probably part of a comunidad de proprietarios . Your lawyer should check there are no outstanding community or municipal charges on the property at the time it is sold

- They should also check there are no other charges relating to the property, that you would legally assume responsibility for if they haven’t been settled. These can include a mortgage, or a case where a property is the subject of an embargo because the owner hasn’t paid their debts

- In different regions of Spain, the property may require different documents, for example:

- If it’s a rural property in Andalucia, it will probably require an A.F.O, which shows it has been legalised.

- If it’s in Asturias, Cantabria, Catalonia, La Rioja, Murcia or Navarra, it needs to have a Cedula de Habitabilidad which proves it is habitable (unless it’s new or is being sold as a project that requires total refurbishment). In other parts of Spain, it will require a licencia de primera ocupación (if new) or licencia de segunda ocupacion (if not new) which also shows the property meets certain standards for safety, hygiene, etc.

- If it’s in a block of flats where the building is a certain number of years old (eg 45 in Barcelona, 30 in Madrid, 20 in Seville, 80 in the Canaries, etc) it will need to have passed the ITE which ensures the building is still safe (and often, after the first inspection, it has to have a new one every 10 years)

Buy property in Spain: the processes involved

A typical process looks something like this:

- You visit properties you like and eventually make an offer on one. The offer is accepted.

- The agent may ask for a small fee called a señal to ‘reserve’ the property (ie stop showing it to others, take it offline etc). This is possibly acceptable if you are satisfied they are a bona fide agent and you think the house might get snapped up. It should always be accompanied by an official invoice and you should get a receipt. However, you should know that it isn’t legally binding, ie if they receive a better offer, they can simply return the money and you lose the property. So, it might be better to simply jump to the next stage as quickly as possible

- You request a mortgage (hipoteca) from your bank if you need one. In practice, it’s a good idea to have already been to your bank to find out how much they are likely to lend you and what it will cost you.

- You get your lawyer to check the property’s paperwork so they can then draw up a contrato de arras to formally reserve the property. In some cases, the agent or the seller will offer to draw this up for you. In any case, always have your lawyer check it over. There are different types of arras, as you will see in our section on terminology.

- Your lawyer checks the property’s paperwork, including the nota simple, certificado energetico, certificado libre de cargas, licencia de primera/segunda ocupacion and, depending on the part of Spain you are in and the type of property, the ITE, A.F.O., and Cedula de Habitabilidad.

- You sign the contrato de arras and pay a deposit (usually 10% of the agreed sale price). The arras also says when and where you will sign the escritura (deeds) to formalise the sale.

- You meet at the notario (notary), where you sign the escritura (deeds), pay the remaining amount for the property, and receive the keys.

If either you or the owner withdraws from the process after signing the arras, there may be penalties applicable, depending on the reason. See our section on the different types of contrato de arras and different regional laws.

Buy property in Spain: the costs involved

If you want to buy property in Spain you will typically need to take the following costs into account:

The agreed sale price, which will usually be paid as follows: 10% at the time of signing the contrato de arras, and the remaining 90% when you sign the escrituras. If you decide to pay a señal before signing the arras, this should be deducted from the amount owing, too.

A transfer tax (ITP) of around 6-11% of the sale price (depending on the region of Spain and the price of the property, see our dedicated section). If the property is a new build, you do not pay the ITP. Instead, you pay VAT at 10% and AJD (to get the new build documented) at 1.5%

Lawyer’s fees including checking the property’s documentation, drawing up the contrato de arras, and checking the escritura Cost: usually 0.5%-1% of the property price. If it’s a complicated property eg a rural property without all the documentation, or one you buy for a reduced price knowing there are okupas (squatters) in it you can expect to pay more. It isn’t a legal obligation to use a lawyer, but it’s highly recommended.

Notary fee (for drawing up the deed and officiating over the signing). This is usually 0.2%-0.5% of the property price, plus up to €100 per physical copy. Note: As a general rule (and in Andalucia or Valencia), the notary fee is paid by the seller and the fee for the copies of the escritura is paid by the buyer. However, this can also vary by autonomous community. So, for example, in Catalonia notary fees are paid by the buyer, in Navarra they are split 50/50

Registry Fee (to have the new owners officially registered). This is usually around 400-750 euros.

Bank fees for doing an immediate transfer to the vendors while you’re at the notary, or for providing you with a cheque nominativo to purchase the property with. This will depend on your bank, but it can be up to 0.4% of the amount on the cheque/transfer

Mortgage fees: Obviously these will depend heavily on which bank you choose, what deposit you have, and what interest rates are on offer. However, before obtaining any mortgage you will likely be obliged to pay for the property you have in mind to be valued by the bank. This is called a tasación. The fee for this will depend on the property but is likely to be between 350 and 600 euros.

NB if you are buying from someone who is not officially resident in Spain, you will have to withhold 3% of the sale price to cover the seller’s capital gains (plusvalia fiscal) obligations, and pay their municipal capital gains (plusvalia municipal) obligations (also deducted from the sale price). Consult your agent and/or lawyer about this.

Note on Hunters & Tourist Licences

A couple more things to be aware of before purchasing in Spain:

Hunters

If you buy a rural property with land, be aware that it is quite hard to fence it off, and people (including hunters) generally have the right to roam on it. You need a good excuse to fence of part of your land (eg livestock). There are rules that say hunters cannot come within a certain number of metres of your house, but that’s generally it. Check this with your lawyer before purchasing. NB some people don’t mind this as the hunters are only allowed on certain days of the year and generally give the landowner some meat if relations are good. Others successfully ban hunters from their land by going through the town hall, but then begin their lives in a new community with half their neighbours not liking them much.

Tourist Licences

Be aware that in order to rent your property out to holidaymakers, you will need to obtain a tourist licence. In some towns, these are no longer given out. In some towns, if you buy a property that has one, you inherit the licence, but in others, this is not the case. Also, if your property is in a block of apartments or a development (ie it is part of a comunidad de vecinos) then in some towns, even if you obtain a licence, your comunidad can prohibit your activity if enough of them vote against it. Check all this for your property with your lawyer if this is part of your plans!

More articles that may be of interest:

Residency in Spain for EU citizens: our easy to follow guide

Residency in Spain for EU Citizens If you are an EU or EFTA citizen, you

Move to Spain -practical information to help make your move to beautiful Spain easy

Move to Spain If you’re thinking about a move to Spain, there’s quite a lot

Visiting Spain – all the information you need for an easy stay in this beautiful country

Visiting Spain Use this page to guide you to the information you need On this

EES Spain: Our easy to follow guide

EES Spain If you are wondering what the EES system is and how it will

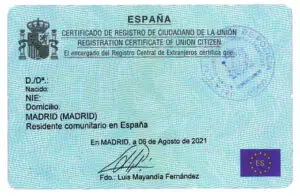

How to get the green NIE (Certificado de Registro) An easy to follow guide

Get your ‘Green NIE’ (Certificado de Registro) The Certificado de Registro de Ciudadano de la

How to Get a Certificado Digital: An easy to follow guide to getting this essential tool

How to get a Certificado Digital If you want to save huge amounts of time

Share this page